Chinese Firms Spend 90 Billion RMB on Censored Nvidia Chips

The Financial Times has revealed a significant scoop. Despite US sanctions, Nvidia is expected to export one million AI chips to China this year, with a total value of approximately £9 billion (RMB 90 billion). According to the US government’s ban, Nvidia cannot export its top-of-the-line H100 and A100 chips to China. To access the Chinese market, Nvidia has specially introduced a watered-down version, the China-specific H20 chip.

Compared to the H100, the H20’s performance is only 15% that of its predecessor. This means that 80% of its computing power has been cut. Yet, even this watered-down H20 chip is in such high demand that it can only be obtained by bidding, and it sells for over RMB 110,000 domestically, with prices reaching up to RMB 150,000 per unit. Nvidia has truly made its chips more valuable than gold, breaking through a market capitalization of $1 trillion, becoming the most powerful money-printing machine of our time. Why are Chinese companies scrambling to buy the watered-down H20 chips? The key lies in the significant technological gap.

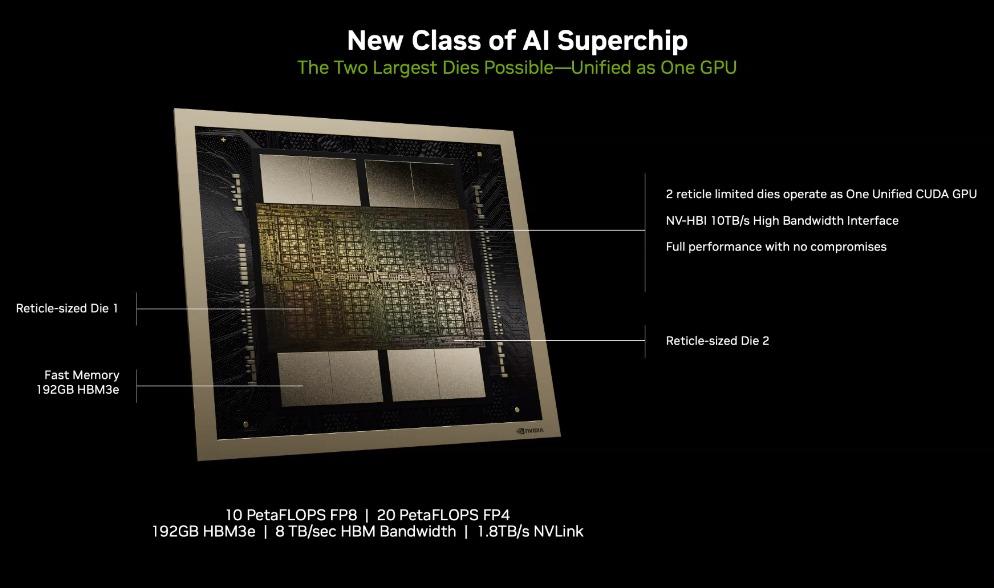

Many people do not realize just how large the gap is between China and the US in AI computing chips. Simply put, the H20 chip, even after being watered down by 80%, remains at the top tier in the Chinese market. Huawei’s Ascend 910B, which is already the strongest in China, pales in comparison to Nvidia’s strongest B200 chip, which has a computational speed more than 14 times greater. This means that when training large AI models, the Nvidia B200 offers higher efficiency, faster speed, can handle larger data volumes, and consumes less energy.

However, compared to the China-specific H20, Huawei’s Ascend 910B has twice the performance. So why don’t Chinese companies increase their procurement of Huawei’s Ascend 910B chips? This is because Huawei’s chip production capacity is limited, and they simply cannot keep up with demand. Moreover, Huawei itself is a strong competitor in the field of large AI models, and other companies do not want Huawei to have insight into the training state of their own models.

One significant difference between Huawei and Nvidia is that Nvidia sells chips but does not develop large AI models. The major external customer for large quantities of Ascend 910B chips is primarily Baidu, who purchased 1,600 units at once. Apart from Huawei, Cambricon also released the MLU370 chip, but its computing power is on par with Nvidia’s A10. In the AI chip domain, aside from Huawei, no other company is competitive. However, Huawei’s chips are subject to sanctions and cannot be manufactured by TSMC, limiting their production capacity. Conversely, Nvidia relies on TSMC for mass production.

Why is TSMC not afraid of Huawei? This is because TSMC and Huawei are not competitors; Huawei focuses on chip development, while TSMC specializes in chip manufacturing. They are partners, not rivals. TSMC possesses the world’s most advanced photolithography machines, whereas Huawei does not have any. TSMC’s true rival is SMIC.

Given that the H20’s performance has been so severely curtailed, why are Chinese companies still frenziedly buying them? This is due to the vertical application of AI large models. When the AI industry first exploded, ChatGPT and similar general-purpose large models quickly ignited a global storm. However, these general-purpose models face three major challenges:

First, they are extremely expensive. Microsoft invested 10 billion to support OpenAI. This level of investment effectively blocks the path for other startups, as no startup can afford to spend 10 billion. Even OpenAI had to rely on Microsoft’s backing to survive. Thus, only super-large corporations can afford to develop general-purpose models, leaving small startups out of the game from the start.

Second, they require massive amounts of data. The more comprehensive the model aims to be, the more extensive the data required. OpenAI does not have its own data sources, relying entirely on data provided by Microsoft.

Third, they need vast numbers of top-tier AI chips. Insufficient computing power cannot handle complex databases. While OpenAI can purchase Nvidia’s top-of-the-line AI chips, China can only acquire the watered-down, China-specific versions. For these models, the road is blocked by the chip shortage.

So what can China do? This is not just a problem for China, but also for the US. When you lack sufficient funds, top-tier AI chips, and vast data sets, how can you enter the AI era? The answer is vertical applications.

Instead of developing general-purpose models, focus on specialized models. For example, if you want to create autonomous driving technology, develop a specialized model that only needs to process national traffic data. If you want an automated food delivery robot, tailor a specific model for the restaurant environment. If you want a film rendering model, create a specialized AI model for film rendering, along with dedicated models for painting, writing, pesticide spraying, and more.

These models are closely aligned with specific industries, ready-to-use, and profitable upon sale. Because they are specialized, the required data volume decreases, and the operating scenarios become smaller, thus reducing the need for high computing power. Conversely, in these specialized areas, China can potentially surpass the US. While ChatGPT is broad and comprehensive, specialized models are focused and precise. In specialized fields, specialized AI models have a greater advantage.

This is the root cause behind Chinese companies’ mass procurement of the watered-down H20 chips—the ecosystem of the AI industry has changed. The entire market is shifting towards lower investment, lower computing power requirements, and lower chip performance standards, but still capable of adapting to various vertical markets, following a smaller yet more precise route.